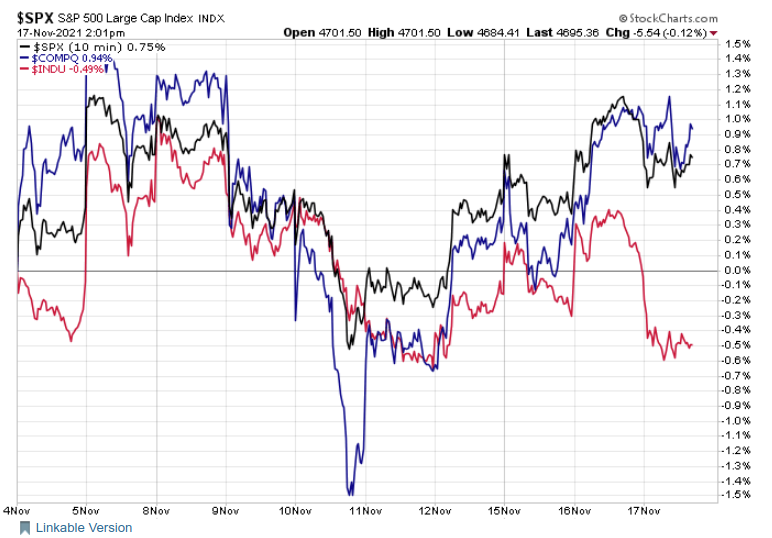

On Monday, November 15, all three major indexes — the Dow, the S&P 500, and the Nasdaq — looked poised to run red for the week. On Tuesday, we saw a strong reversal in the downtrend. Then we saw a reversal of the reversal on Wednesday, and here we are today — heading into the weekend with markets moving but in no particular direction, as highlighted in the 10-day “Big Three” chart.

Or are they?

Looking at the 10-day chart, it sure looks like we’re knee-deep in sustained sideways action. But I actually see a divergence that looks more rotational than folks exiting the market.

I want us to look at this next string of five-day charts. First let’s look at the S&P 500’s five-day chart:

On November 15, the S&P’s 50-day (blue line) and 200-day (red line) moving averages made a “golden cross.” This is historically one of the strongest bull signals chart technicians look for.

We can see the exact same thing when we look at the Nasdaq’s five-day chart.

Now here’s where things get interesting. If we look at the Dow chart for the same five-day time frame, we get a much different picture than the one presented by the S&P and Nasdaq charts.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

In fact, we have a strong bearish signal showing for the Dow in contrast to strong bullish signals from the S&P and Nasdaq.

As you can, see just like its counterparts, the Dow saw its 50-day MA cross above its 200-day MA. This is most likely powered by a singular event — specifically Boeing’s (NYSE: BA) huge surge the other day. But unlike the S&P and Nasdaq, which remained at their new higher levels, the Dow came crashing back down Wednesday and is at risk of its 50-day crossing below its 200-day — a strong bear signal.

So what does this all mean?

Ride the Tech Wave Through Q4 and Sell Your Dow Stocks

In the spirit of giving thanks this holiday season, I want to give you some guidance on all the investment recommendations I’ve made this year, including how to lock in some profits today.

Over the past year, we’ve recommended a slew of stocks to you — some in the tech sector, some oil plays, some growth stocks, and some value stocks — but that’s only half my job. The quality of our investments is really only determined by how much cold, hard cash these investments put in our pockets.

If you’ve followed our trade suggestions this year, congrats! You’re in a great position to lock in some major wins today.

Here’s what I want you to do if you acted on any of our trades this year and added these suggestions to your portfolio.

Back in December 2020, my colleagues and I predicted the oil and energy sectors would be a top sector to invest in this year.

As such, I recommended Baker Hughes Co. (NYSE: BKR), Chevron Corp. (NYSE: CVX), and Valero Energy Corp. (NYSE: VLO). I think the oil trade has cooled off a bit. By selling today, we can lock in 17%, 26%, and 23%, respectively.

Let’s also take our 20% return off the table with our stake in Northrop Grumman (NYSE: NOC) and lock in 11% on our Kroger Co. (NYSE: KR) position. That should wrap up our guidance on open value trades.

Now let’s talk about our tech stocks.

Our Taiwan Semiconductor Manufacturing Co. (NYSE: TSM) trade has yet to lift off like our other semi play, Advanced Micro Devices (NASDAQ: AMD). As such, I want you to just sit on your TSM stake for now.

Looking at our other tech plays, I want you to sell half of your stake in Microsoft (NASDAQ: MSFT) and hold onto the remaining half for more gains over time. I have no doubt this trade will run higher in time, but I expect a pullback post-earnings and you deserve a little extra cash for the holidays! By selling today, you should be able to lock in a nice 51% return!

I also want you to do the same thing with our stake in AMD. Sell half and let the remainder ride for bigger gains. By selling today, you should lock in about 87% in a trade that we opened in June. Congrats on your conviction to have faith in our suggestions!

Have a great weekend.

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter